Contents

- Online payment methods

- So why do you need online alternative payment methods?

- âShould I rely on merchant payment aggregators or not?â

- What has our experience taught us?

Online payment methods

Getting elbows deep, you need to understand the process from start to finish, so you avoid hiccups and make the most appropriate decision. With a multitude of algorithms, licenses, solutions and aggregators – the process of choosing the right solution can feel overwhelming. We get it, and we’re here to help.

Payment methods vary across the world, catering to differing financial audiences which can further complicate the process for a merchant trying to better understand where his customers’ money goes. From experience, we recognise that the process and technicalities about settlement periods and payment gateways are far from simple, even for financial experts, so we’ve created a guide with some food for thought when choosing the right online payment solution for your business.

So why do you need online alternative payment methods?

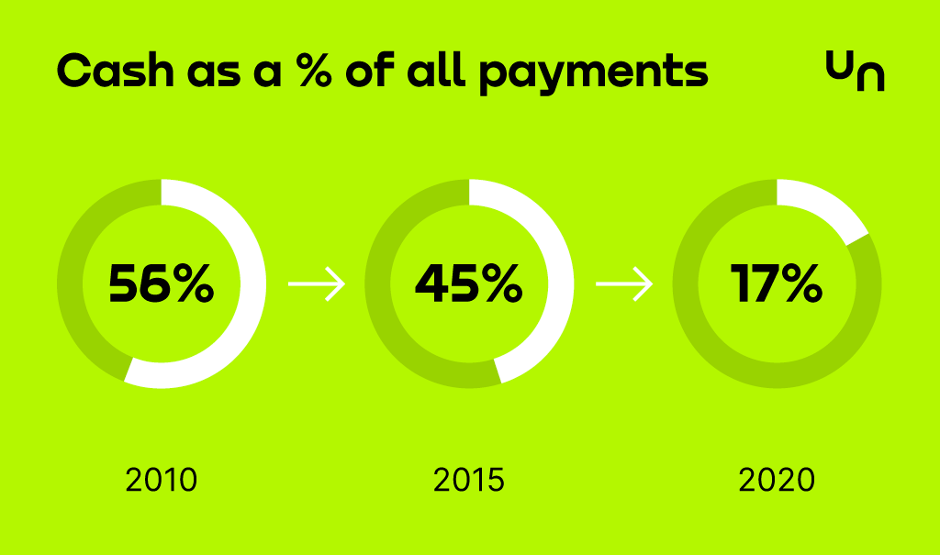

Online payments are soaring with a variety of options driving different consumers adoption. Bank transfers, e-wallets and buy now pay later schemes are some of the popular alternatives to cards. As of December 2020, a total of 249 million online card transactions were made in the UK, showing an increase of approximately 8%. 1 With this growth, we see the minimisation of cash payments which have plummeted to below 20% of all payment methods. 2

Alternative payments methods are becoming trendier, as more shoppers venture online for purchases and are not limited to their localities. Merchants often select a number of payment gateways or a payment aggregator to support with online payments, as well as offline payments. As a merchant who embraces online payment methods, you can achieve the following:

- Reduce risk of fraud

- Minimise cart abandonment

- Increase your customer base globally.

With an ever-progressing society, the rise of alternative payment methods to support online transactions, is proven to significantly market shares for merchants by driving stronger customer conversions.

‘Should I rely on merchant payment aggregators or not?’

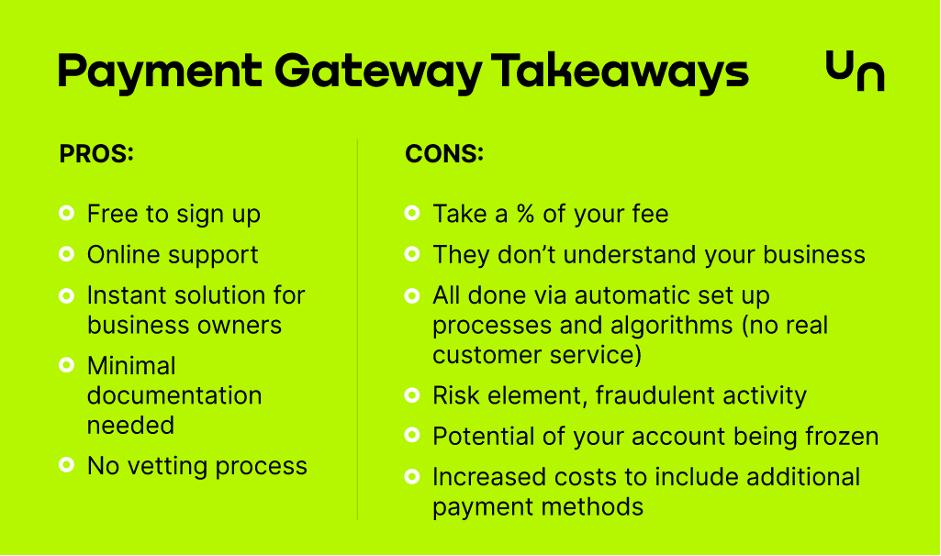

When looking for payment solution providers the terms ‘payment gateway’ and ‘payment aggregator’ are thrown around a lot. It can be confusing, so we’ll keep it as simple as possible. A payment aggregator is a service provider that provides various payment methods to merchants, typically through a single touchpoint like a wallet.

Payment gateways include popular names such as PayPal, Stripe, Square, etc. but are limited in the types of transactions that they can process. Unlike a payment aggregator, the payment gateway is limited to online payments and particular payment methods. Payment aggregators are largely driven by fintech, like Unlimit. They are a service provider which enables merchants to accept multiple payment methods online and offline, without having to set up numerous accounts with each service or different banks. Irrespective of payment method, time and location, merchants can use a single interface to manage the payments for their business.

When turning to an online payment system, ask yourself some questions before you choose a payment service provider:

- Does it embrace popular payment methods in the countries you want to access? Traditional payments such as Visa and Mastercard are well known, but a number of countries have bespoke local payment methods which are popular. It’s important to consider that if you want to span internationally, that the online payment method you choose, is inclusive of local payment methods. Using ourselves as an example, Unlimit’s 12+ years of knowledge has taught us to immerse ourselves locally in key markets, which allows us to confidently say we have true local expertise. The solution you choose should guarantee increased presence in the marketplace via access to multiple currencies and payment systems such as wallets, cash payments, prepaid cards.

- Is it secure? Are they a trusted name? The Payment Card Industry Data Security Standard (PCI DSS) is a thorough way to ensure that a payment provider is handling data correctly. Requesting evidence of the payment provider’s compliance with these standards is fundamental. Remember that even a merchant is obliged to adhere to the same guidelines to create a safe and secure digital experience.

- Is it reliable and protected by antifraud? In the current digitally driven financial world, payment fraud detection systems are a necessity. These systems should be working beyond static identity data in order to make better-informed risk decisions whilst supporting any business and client with online payments process. For example, Unlimit’s solution works in tandem with the BPC SmartVista Fraud Prevention Module. This system works in real time and uses data to analyse risk, rather than relying on an automated algorithm which locks down a merchant account at any given time.

- Is a payment aggregator better for my business? The reality is – nobody can make that decision for you. But we can give you the facts to help you decide. The benefit of a payment aggregator is not only the cost and inclusion of numerous payment methods, but also the simplicity for the end user. With a single interface to control your business, a merchant has full view of what, how, where and when transactions are taking place. Not only does this help a merchant to better channel their business to the right audience, but also benefit from an evolving payment provider driven by fintech.

- Is this solution easy to use? Elements to consider are whether the solution is flexible, how simple the integration is for users and what technical support is available. If you have a cohesive understanding of technology and finance, automated support such as chatbots or online FAQs may be enough. For many merchants, they want to be able to focus on their main service provision and not nitty gritty details. That’s why it’s important to ensure that the solution has a simple interface which is easy to use, and that support is accessible and easy, should you need it.

- Is it diverse to the future of technology? Fintech is everchanging alongside the business needs of merchants, to ensure that the evolution of technology is a response to business and consumer needs. That being said, to enable you to reach a wide audience, your payment service provider should have a flexible solution which will adapt to changes with online payments. An element that Unlimit values is analytics. This overlooked feature is integral to any merchant seeking to become a leading brand because it provides you with insight to leverage as you grow. Having clear visibility of your customers’ journey can make a huge difference.

- What is the onboarding process like? Easy and supported onboarding processes are, needless to say, a popular choice. How quickly are you trying to excel your business, and does the onboarding process fit that vision? At Unlimit we’ve listened to our merchants and our fast onboarding is a testament to our experience and understanding of what merchants need.

What has our experience taught us?

Unlimit boasts over 12 years of experience in the financial services field, and offers over 1000 payment methods as well as a variety of solutions across banking, gaming, card issuing, etc. By having our feet on the ground, with people connected in the local markets, we stay at the forefront of future developments and opportunities that arise in those local markets. And it is through being part of certain key communities that we are privy to new changes or new products coming into certain markets which our in-house development team deliver to you.

As an acquirer, Unlimit is also able to offer the best approval ratio across the world, particularly within regions which we hold additional local acquiring licenses. Prevalent in Latin America, Asia and more; we connect to numerous acquiring banks, card and payment networks for a seamless service. We truly are connected within communities around the world; transcending financial borders.

Benefits of a PSP, like Unlimit include (but are not limited to):

- Vetting process to ensure we’re mutually the right fit for each other, but not as lengthy as banking services

- We care for your business – so we understand your business model and know what payment activity to expect, so there won’t be any surprise freezes

- Flexible to your business by accepting numerous payment methods from across the world

- User-friendly interface which is designed for the end-user, with no complexities and convoluted applications

- Single payment gateway for merchants, including different banks, localities and currencies – so you can expand across borders rapidly

- Robust interface continuously evolving and providing key functionalities like split payments, tokenisation, etc.

- We connect to multiple acquiring banks, cards and payment networks to provide a seamless service as well as hold our own local acquiring licenses in regions of our presence (LatAm, APAC, EU and UK)

- Manage relationships with external networks which allows merchants to remain independent from financial institutions and having to manage each connection directly, especially when operating internationally

- Cheaper fees because of single integration and deals

- Fraud protection with our risk management processes, for card and bank-based payments.

Transcend borders and disrupt tomorrow, with Unlimit. But don’t just take our word for it, click here to meet one of tomorrow managers to find out more.

1 https://www.statista.com/statistics/1015722/number-of-card-transactions-online-united-kingdom/

2 https://www.ukfinance.org.uk/sites/default/files/uploads/SUMMARY-UK-Payment-Markets-2021-FINAL.pdf